open ended investment company taxation

The terms OEIC and ICVC are used interchangeably with different investment managers favouring one over the other. An open-ended investment company OEIC is a body corporate which owns and manages investments.

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum

Generally an investment company is a company corporation business trust partnership or limited liability company that issues securities and is primarily.

. Open-End Funds on a state-by-state basis. A money market mutual fund is a no-load open-end investment company registered under the Federal Investment Company Act of 1940 which attempts to maintain a constant net asset. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c.

The interest income obtained from participation in the. If the special regime for investment funds does not apply open-ended funds regulated under Law 352003 are subject to the general corporate income tax regime. Additional rate - 381.

They form part of many client. July 9 2013. Instead investors pay tax when they receive income or realise a capital.

Open-end investments such as mutual funds do not pay taxes on their own but also pass on the tax burden to their investors. By Anthony Stewart Laura Underhill and Violet Marcel Clifford Chance LLP tax group and Simon Crown Clifford Chance LLP regulatory group. Open ended investment company taxation Sunday March 20 2022 Edit.

In addition the percentage of income that represents a tax preference item. ɔɪk or investment company with variable capital abbreviated to ICVC is a type of open-ended collective investment formed as a corporation under the Open-Ended Investment Company Regulations 2001 in the United Kingdom. The performance of the investment company will be based on but it will not be identical to the performance of the securities and other assets that the investment.

These percentages may be useful in completing your state tax return. An open-ended investment company abbreviated to OEIC pron. Both open-ended and closed-ended retail funds are treated as fiscally transparent under the Mexican Income Tax Law.

These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of Chargeable Gains Act 1992 c. If a portion of the expense remains to be amortized at the end of the period the balance is commonly reflected. Tax within the fund.

Any profit you make when you sell your shares will also be subject to Capital Gains Tax. The tax rules aim to put the investor in broadly the same position as if they had invested in the funds assets directly rather than through the fund. Ad Dont miss out on opportunities open an account in 10 minutes.

An open-end investment company is the technical term for a mutual fund. These Regulations make provision for the tax treatment under the Tax Acts and the Taxation of. Statutory trust registered as an open-end management investment company under the Act and whose shares are registered under the 1933 Act.

Unit trusts and Open-Ended Investment Companies OEICs are professionally managed collective investment funds. The direct tax treatment of OEICs is established by the Authorised Investment Funds Tax Regulations 2006 SI2006964. Meaning of open-ended investment company - section 613 Corporation Tax Act 2010.

Find out more about on the GOVUK website. Shares of the VIP Trust and the FOF Trust are. 12 the 1992 Act of open-ended investment companies.

A fund manager pools money from many investors and buys. 12 the 1992 Act of open-ended investment companies. An open-end investment company makes a continuous offering of its shares that are redeemable.

Offering Costs amortize to expense over 12 months on a straight line basis. Investment companies like other funds are designed to be tax-efficient investments. You can invest in.

An open-end investment company issues and redeems or buys back shares in the mutual funds it sponsors on a continuous basis in response to investor. This practice note provides an overview of the. In the UK OEICs are the preferred legal form of new ope.

Little or no tax is paid by the fund. This means investors pay taxes on any capital. OEICs Open Ended Investment Companies and unit trusts are commonly used collective investments and share the same tax treatment.

CG41562 - Open-ended investment companies OEICs.

Selling Stock How Capital Gains Are Taxed The Motley Fool

4 Types Of Business Structures And Their Tax Implications Netsuite

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

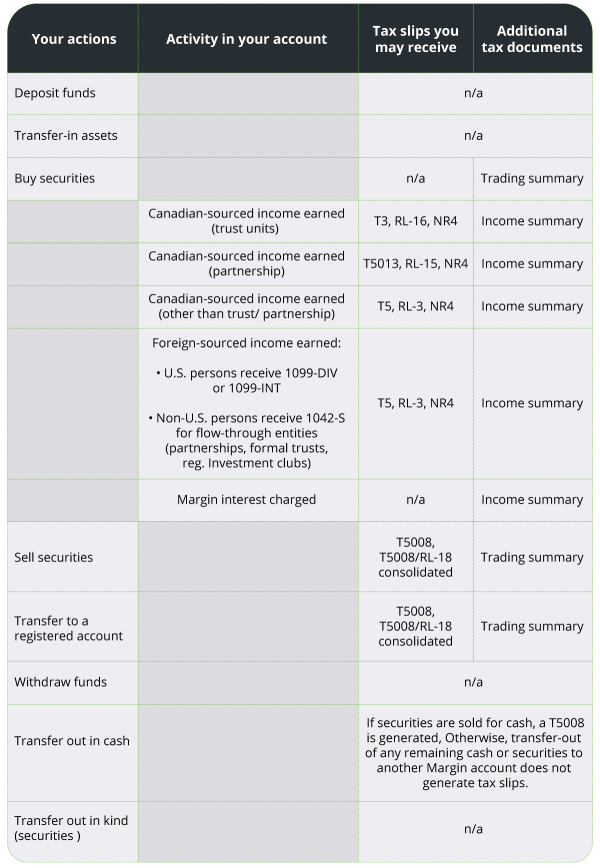

Understanding Taxes And Your Investments

Tax Efficient Investing In Gold

What Are Open Ended Funds Meaning Difference Advantage Disadvantage

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Difference Between Open Ended And Closed Ended Mutual Funds

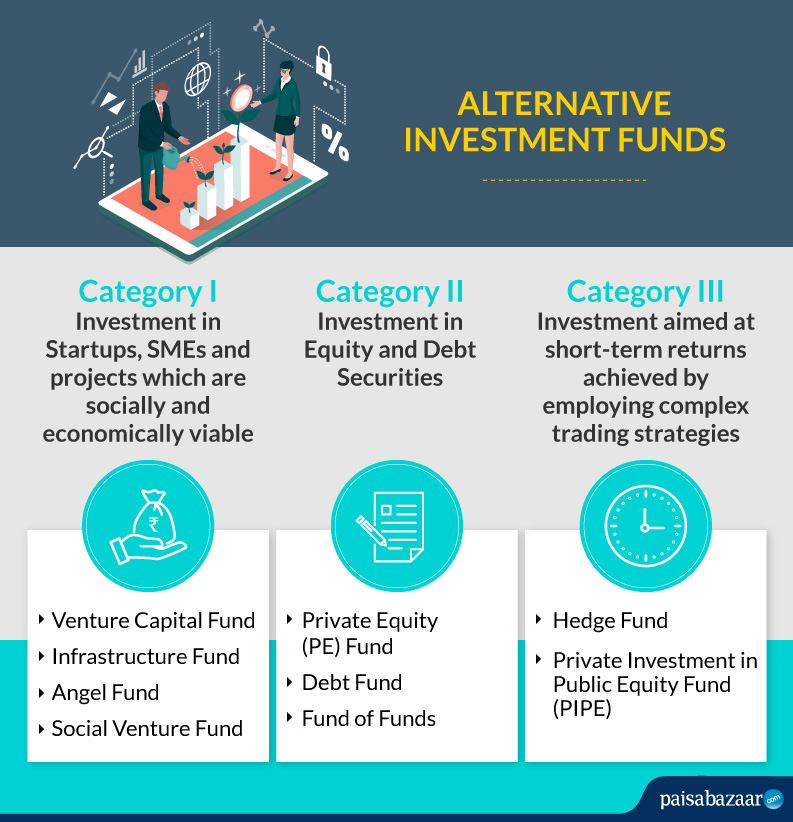

Alternative Investment Fund Know Types Taxation Rules List Of Best Aif

Turning Losses Into Tax Advantages

Tax Efficient Investing In Gold

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Difference Between Open Ended And Closed Ended Mutual Funds

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)